Developing Products for a New Customer Category

Trexin helped a specialty insurer expand its business model and operational capability to serve the individual market.

Business Driver

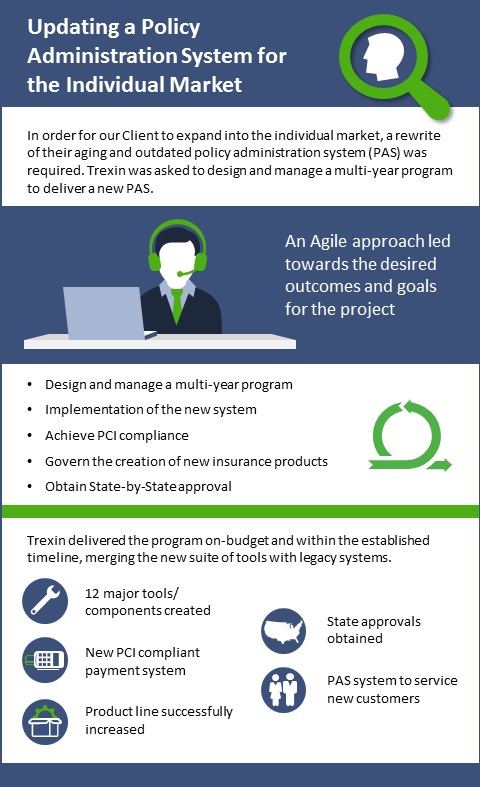

The President & CEO of a global leader in voluntary legal insurance benefits asked Trexin to help expand their business to develop insurance products for a new category of customers, the individual market. Traditionally, our Client served large employer groups of 1000 employees or more, but they sensed an opportunity to serve individuals as well. One obstacle to business expansion was that the individual market required a rewrite of their policy administration system (PAS), which was aging and built upon outdated technology. In that context, the CEO asked Trexin to design and manage a multi-year program to deliver a new, modular PAS leveraging modern computing technology; lead the implementation of the system leveraging an Agile development methodology; provide Agile coaching and mentoring; conduct a vendor selection for a new payment processor; achieve a state of PCI compliance; and govern the creation of new insurance products that required authoring the policies, filing them with each of the States, and revising the verbiage and underwriting components to obtain State-by-State approval.

Approach

Trexin began with several pre-planning workshops with our Client’s leadership team to gain consensus and alignment on the desired outcomes and goals for the project. Once we had established a common understanding of where we were headed, we designed a program structure that outlined the various workstreams that would deliver different functions of the new platform, including software development, PCI compliance/vendor selection, and product creation.

Trexin led an Agile project management methodology to ensure frequent delivery and review of the system, which allowed for changes to code before heading too far down a given path. The development team still had commitments to support the existing PAS so we had to ensure a balance of new product development time coupled with daily support responsibilities. The Agile approach also afforded us the opportunity to address issues more quickly.

Results

Trexin delivered the program on-budget within the established timeline. The go-live was successfully executed overnight, merging the new suite of tools and websites with legacy systems. In total, twelve major tools and customer facing components were created or updated including a new PCI-compliant payment processing system that allowed our Client to accept and manage credit card payments in an automated manner, which had never been done before. Our Client’s insurance product line was successfully increased to meet the needs of the new individual market. All State approvals were obtained and new customers could be properly serviced through the new PAS that was created.